Approach to the LCoE of Solar PV for Chilean Mining

In this article we will discuss about the Levelized Cost of solar PV Energy (LCoE – PV) in Mining for Chilean regions at «Norte Grande». We also study the components of the LCoE (Capex, Opex, Financial Costs and Income Taxes) in other article related. We will use mainly two units: cents of USD/kWh (some figures) and USD/MWh (most common terms used by utilities and mining).

The most important result is the huge difference between the levelized cost of solar PV energy, (92 USD/MWh) and levelized energy costs of fossil fuels that dominate the region by 99% (216 USD/MWh). Potential cost savings will achieve 187.5 TWh/25 years, in economic terms we are talking about 27,113 million of USD/25 years of savings.

Our approach consider three basic models.

LCoE PPA Model: A model that takes into account the financing and can serve both mining companies to guide them in the PPA as well as utilities in the area, EPC, or equity investors and / or debt.

Turnkey LCoE Model: A model regardless of the funding component likewise useful for mining companies and other members of the ecosystem «Renewable Mining».

BAU Model: Business As Usual model following the current mix of generation in the area (99% fossil fuel power).

In late 2013 our team of collaborators of www.miningrenewables.com conducted a research for technical and financial modeling with the of 67 plants and photovoltaic projects pipeline at tnorthern Chile mining regions (ongoing, approved and / or pending final approval solar PV projects). As a result of this research we will publish a collection of twenty articles on our web blog in order to determine the most appropriate KPI and the mining cluster raise awareness of the importance of this evolution.

About LCoE

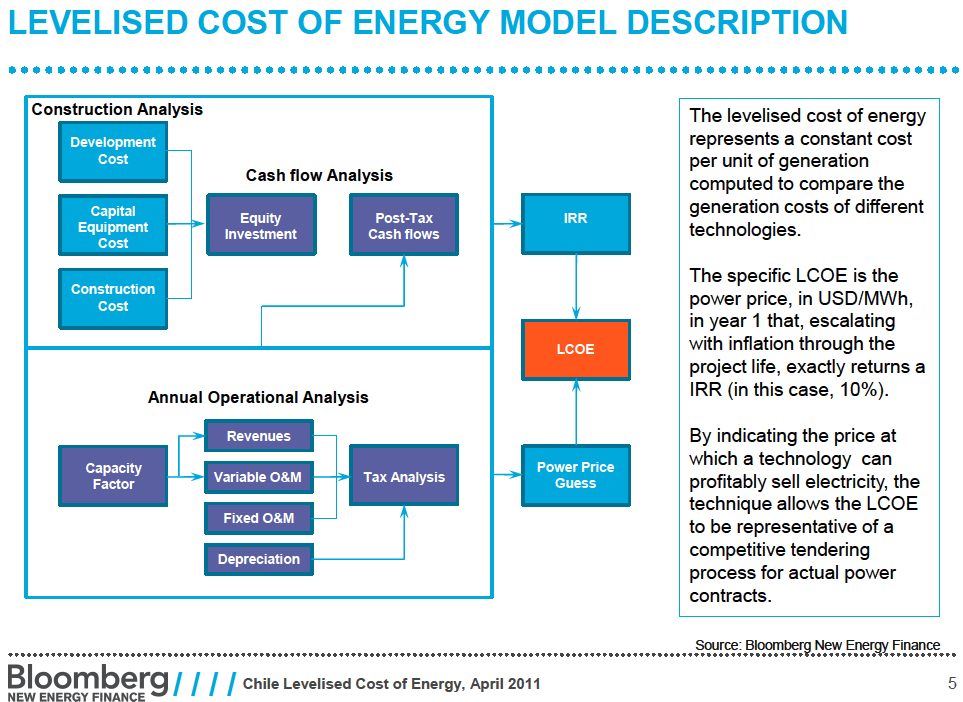

The following figure describes schematically the model of Levelised (or Levelized) Cost of Energy (sometimes Electricity) made by Bloomberg News Finance (2011). The presentation linked to the image explains the costs in 2011. However between 2011 and the end of 2013 cost of solar PV electricity dropped dramatically.

Variables that directly affect the results of LCoE

Otherwise, the following table shows the components of the standard cost of electricity (LCoE) in Chilean mining regions. These data are linked with the development of 67 technical, economic, financial and environmental models.

From an economic and financial point of view, the photovoltaic power plants have 10 main variables affecting the LCoE as follows:

1 – Investment Unit (USD/w)

2 – Nominal Power (sized of PV plant)

3 – Global Radiation

4 – P. R. (Performance Ratio)

5 – Operation & Maintenance Costs

6 – Interest Rate

7 – Loan amount (Leverage)

8 – Return on Equity

9 – WACC

10 – Equity IRR & Project IRR

Each of the precedent variables have been considered for the 67 portafolio of Solar PV active projects analyzed by our team. Thanks to this research we can monitor potencial levelized costs of everyone to the PV Plant for next 25 years and to compare performances of different mining regions. The results of this comparison will be discussed in next article.

Nevertheless, we can anticipate that the Norte Grande Levelized Cost of Energy during 25 years will achieve …

PPA Model: 122.5 USD/MWh

Turnkey Model 71.8 USD/MWh

The LCoE PPA Model regions: Arica 136.7 USD/MWh; Tarapacá 124; Antofagasta 117.5; Atacama 122.5

Moreover our forecast indicates that the average 25-year LCoE related to Business As Usual (BAU) Model based on fossil fuels will reach 215.8 USD / MWh and Year 1 LCoE locates to 115.5 USD/MWh.

What Next?

In future articles we will discuss the components of LCOE and savings in different Chilean mining regions. And finally, we shall show you how 4 PV power Plant in each mining region performs depending on the precedent 10 variables and we will learn that financial constraints are more important than the costs of Upfront investment capex.

Great job!! Amazing!